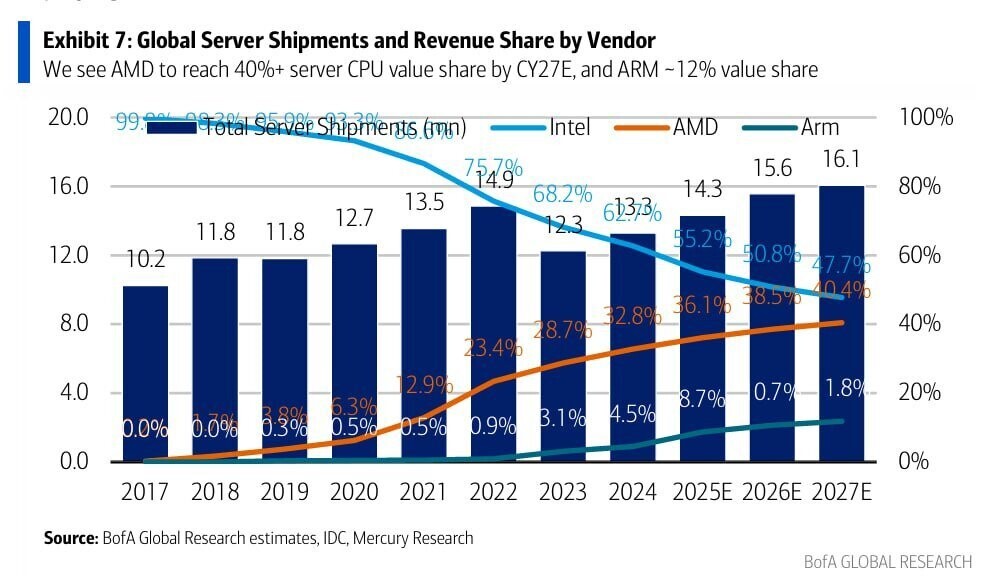

Intel’s Server Share Slips to 67% as AMD and Arm Widen the Gap

In just a few years, AMD has gone from the underdog to Intel’s most serious challenger in the server world. Thanks to its EPYC processors, AMD now captures about a third of every dollar spent on server CPUs, up from essentially zero in 2017. Over that same period, Intel’s share has slipped from nearly 100% to roughly 63%, signaling a significant shift in what companies choose to power their data centers. The real inflection point came with AMD’s Zen architecture: by mid-2020, EPYC had already claimed more than 10% of server-CPU revenues. Meanwhile, Intel’s rollout of Sapphire Rapids Xeons encountered delays and manufacturing issues, leaving customers to look elsewhere. By late 2022, AMD was over the 20% mark, and Intel found itself under 75% for the first time in years.

Looking ahead, analysts at IDC and Mercury Research, with data compiled by Bank of America, expect AMD’s slice of the revenue pie to grow to about 36% by 2025, while Intel drops to around 55%. Arm-based server chips are also starting to make real inroads, forecast to account for roughly 9% of CPU revenue next year as major cloud providers seek more energy- and cost-efficient options. By 2027, AMD could approach a 40% revenue share, Intel may fall below half the market, and Arm designs could capture 10-12%. Remember that these figures track revenue rather than unit sales: AMD’s gains come primarily from high-end, high-core-count processors, whereas Intel still shifts plenty of lower-priced models. With AMD poised to launch its Genoa and Bergamo EPYCs and Intel banking on the upcoming E-core Xeon 6 series to regain its footing, the fight for server-CPU supremacy is far from over. Still, Intel’s once-unbeatable lead is clearly under threat.

Ryan C. Smith has been doing professional computer support since 1996. He worked at all the major companies such as SONY, HP, Network Appliances, Palm and many more. He was top of his class at Heald College for Computer Technology. He is familiar with Windows Servers, Windows, Networking, Linux, and Web Servers. He has a photographic memory when it comes to computers.